Jar Acquisition Project

References

Is the Product ready for Acquisition?

Position in the market:

- 20 million users (as of 27 March 2024)

- Clocks close to 1 million transactions a day.

- Average Jar users save at least 22 times in a month.

- Market leader in digital gold space.

Funding information:

- Total Funding: $111.7M over 5 rounds

- lead investors - 4 and total investors - 37

- Latest Funding Round: $22.6M, Series B, Aug 18, 2022

- Valuation: $305M as of Jan 09, 2023

- Annual Revenue: $1.83M as of Mar 31, 2023

- App Store: 4.6 ⭐ 15K ratings (184 ranking in Fin apps)

- Play Store: 4.4 ⭐ 600K ratings

Elevators Pitch:

Imagine you are at 25, and just started earning money, and your mother comes and asks you to save money so that you can purchase gold for the upcoming sister's wedding. Now you have many options to save money and invest in different ways, but you are afraid of what will happen if the value of the asset decreases when you want to take out your money from the asset. You are also worried that the value of money in cash will be reduced due to inflation. You want to invest in an asset that is easy to invest, maintains good returns, and also can be withdrawn anytime in the future without worrying about the value.

What to do in such a situation?

Don't worry, Jar is here to help you. 💡 Save every day, withdraw any day

We here at Jar, invest your savings in 99.5% pure gold and 24K gold. Also, did we mention the savings can be made as little as 10 Rs a day, and you can invest in lump sums, did we mention you can convert your savings into gold and get them delivered to your doorstep?

Jar helps you in all things related to savings and investing the savings in gold, converting them into Jewelry, and getting them delivered to your doorstep.

💡 Save Money in digital gold from ₹ 10. It’s automatic. Like magic.

A full-time retail investor is worried about stability in the portfolio and wants to diversify the portfolio with low-risk and stable assets. Here comes Jar with daily, weekly, and monthly savings options to continue their savings journey.

Save your money today and your money will save you tomorrow - Jar

Brag worthiness:

- Save your savings into gold in less than 45 seconds

- Save every day, monthly, yearly

- Also, invest in lump sums

- Save as you spend. Jar takes spare change & turns it into gold instantly

- First-mover advantage in the market

Repeatability:

- I have talked with 4 users and all four users open the app daily to invest in savings.

- There are daily and weekly games that give out platform currencies to the users.

- These can be converted into Rs. when the users are purchasing gold. (1 PC = 1 Rs.)

Willingness to Pay:

Some users said they are happy to invest small amounts in the app, and when they reach a certain amount of savings on the app, they purchase the gold convert it into physical gold, and get that delivered to their homes.

Some users said for high-valued items they better go to local shops to purchase gold, but the majority of the users want to invest in digital gold to diversify their portfolio. They have around 2 to 5 percent of their portfolio invested in the gold. They are happy with the features and are willing to pay.

The Jar app gets its revenue through commissions on gold purchases via the sale of service. They also charge users a small amount for maintaining the gold storage crates.

How does Jar Make Money:

The jar makes money in 2 ways.

- Commission earning – The Jar app gets its commission earnings from the gold service providers on the app. Whenever a spare change investment is made into digital gold, Jar gets the commission from the gold providers. Like on the SafeGold platform, the Jar app gets around 2.4% of commission from the gold service provider, for every investment a user makes on it.

- GST imposed – Jar app doesn’t charge commission from its users to use the app, it only charges around 3%GST and a nominal amount of fees is charged for insurance and locker to safely store the gold digitally.

ICPs:

There are primarily 2 ICPs the Jar app trying to solve. One who is not financially literate about savings and investing only knows about FDs. Two professionals who want to diversify their portfolios and save some amount in digital gold.

Demographic | ICP1 | ICP2 |

|---|---|---|

Professional Investors | Daily workers / Small businesses | |

Age | 25 - 30 | 25 - 40 |

Gender | Both | Both |

Location | Tier 1 | Tier 1/2 |

Salary / Income | 12 - 20 LPA | 5 - 10 LPA |

Apps | Groww, Zerodha | WhatsApp, YouTube |

Marital Status | No, Yes - Both | Yes |

Problems | → Not completely aware of digital gold as an investment | → Completely not aware of the savings options in gold |

JTBD | Diversify the investments and stabilize their entire portfolio | Get returns better than FD and save over inflation. Invest in small amounts daily. |

Frequency of Investment | Weekly | None before, But looking for something that helps them save daily |

Frequency of app visits | 3 - 4 times a week | Daily savings - Autopay, check the app once in a week |

Percentage of investment invested in gold | <5% | Invested in physical gold of about 50% |

Top app features | Manual purchase of gold and selling of gold | Autopay - Invest 20 - 100 Rs. daily |

Technology awareness | Very High | High |

Where are they currently investing and saving | Mutual funds | Chit funds |

Professionals | Daily workers / Small businesses | |

|---|---|---|

Do they have previous saving experience? | Yes | Yes, save in FDs, and chit funds |

What is their say on Gold investment | They are aware and see it as another tool for asset investment | Only have an idea on FD investment, but not sure about gold investment as an asset and investing via purchasing gold via Jewelery |

Do they invest in digital gold previously? | In gold ETFs and Bonds | No, Only invested via purchase of physical gold |

Employment | Employee | Business owner / Daily worker |

Mobile type | IOS/Android | Android |

ICP Prioritization:

| ICP1, Professional | ICP2, Business owners/Daily workers |

|---|---|---|

Adoption | High | Medium |

Frequency | Medium | High |

TAM | High | Medium |

Appetite to pay | Medium | Medium |

Distribution Potential | High | High |

Based on the above table, both ICP1 and ICP2 have very high potential to target. For this project, I am targeting ICP2 because the job that the product is solving for is very similar to what users are searching to hire for.

Also, the frequency is daily as they want to save their daily earnings.

Challenges with the ICP2:

Since these users are new to digital investments, particularly in gold. It is difficult to gain trust initially. To build trust we can use the existing users and show their testimonials, and videos about their experience.

TAM, SOM, SAM:

As per a KPMG report, the Indian digital gold market size is projected to become a $100 Bn market opportunity by 2025.

Total Addressable Market:

Total Population: 1.4 Billion

Sources:

- Ministry of Information and Broadcasting Secretary Apurva Chandra report said that India has over 1.2 billion mobile phone users and 600 million smartphone users (2022 report).

- As of the end of April 2024, India had 154 million demat accounts.

- As of March 31, 2024, the Income Tax Department reported that 74.67 crore PAN cards have been allocated in India

- Mobile Phone users: 85.6% of the population → 1.2 Billion

- Smartphone users: 60% of the population → 720 Million (Assuming there is a slight increase in smartphone users)

- No of users who have linked Aadhaar with Pan → 573 Million

- No of users who have demat accounts → 153 Million

ICP2: Daily workers or Business owners:

No of Pan card users: 74.67 crore → 747 Million

No of people who do not have demat→ 594 Million

No of people who have bank accounts - 482 Million

Number of users in tier 1 and tier 2 cities → Assuming 60% → 289 Million

Same can be confirmed via Blume report → India A + India B → 120 +300 m → 400 Millions

As discussed in the above section "How Jar makes money", let us take Jar getting around 3% overall commission from both ways. Also, let us assume that on average a user invests around Rs. 3000 per month on the Jar via daily savings.

Total investment on Jar = 12*3000 = Rs. 36000

So, the total revenue opportunity for the Jar from TAM is: USD 1.3Bn or Rs. 10,400 crores

Serviceable Addressable Market:

| ICP2, Business owner/Daily worker |

|---|---|

Age group | 25 - 40 |

Population in this group | 450 Million |

Income between 5 to 10 Lakhs (IT dept) | 230 Million |

Population in tier 1 and tier 2 cities - 50% | 115 Million |

Population with digital tech savviness - 10% | 11.5 Million |

Average savings per person per month | Rs. 2500 |

Potential revenue for Jar | Rs. 34500 crores |

Commission from the savings and investments - 3% | Rs. 1035 crores |

Serviceable Obtainable Market:

Jar has the first movers advantage in the market and also the maximum number of users in the current market. Assuming this continues to do so. I am considering we can acquire 30% of users. So the SOM for the Jar is:

| ICP2 |

|---|---|

Population with digital savviness | 11.5 Million |

Market share for Jar - 50% | 3.45 Million |

Average savings | 2500 |

Revenue for Jar from Investments | Rs. 10,350 Crores |

Commission from the transactions - 3% | Rs. 310.5 Crores |

The total SOM revenue potential for the Jar app can be INR Rs. 310.5 crores.

Core Value Proposition:

💡 Invest daily, weekly, and Monthly

💡 Invest lump sums

💡 Convert savings or investments into real gold

💡 Get easy deliveries to your doorstep

💡 Enjoy 12% interest on loans

💡 Roundoff savings via daily payments to merchants

💡 Make the investments via UPI or Cards

💡 Withdraw anytime, no questions asked

💡 Save your savings into gold in less than 45 seconds

Acquisition:

Channels:

- Organic (Push + Pull)

- Referral

- Paid Ads

- Influencer Marketing

- Product Integrations

Channel Selection

Channel | Cost | Flexibility | Effort | Speed - Lead time | Scale |

|---|---|---|---|---|---|

SEO or Search | Low | Low | Medium | Slow | High |

Social Media Influencers | High | High | High | Medium | High |

Paid Ads | High | High | Medium | High | High |

Organic - Content loops | Medium | Low | High | Medium | Low |

Referral | Medium | High | Medium | High | High |

Partnerships | High | High | High | Medium | Medium |

Clear view:

I am selecting Referrals and Partnerships because

- Influencer marketing and paid ads cannot be used since we are in the post-PMF and early scaling phase and do not want to spend more on these channels.

- SEO and Search are not considered because the majority of the users (ICP2) do not use search.

For Referral, since we already have users who have experienced core value propositions, users are more inclined to share about the app and increase WOM.

Referral:

How referral works in the current scenario:

The app currently shows referrals on the home screen for early or new users without any validation of user satisfaction. There is no harm in keeping this option but asking for referrals to the user once they have validation will be a great approach.

Issues in current referral message:

In the current referral message, the messaging is not done correctly. For example, not everyone can understand Hindi. There might be users from another language. They will not understand the messaging. The referral can be sent to a family member or a new contact that they have connected recently. Starting the message with "Dosth" is incorrect.

To resolve this issue, we can provide users with an input option to customize the referral message. We can ask the user about the name of the user. We can provide customization using the language selection option, and the user can select different languages like English, Telugu, Hindi, Tamil, Kannada, Malayalam, Marathi, etc..

Sample screen:

When a user clicks on Invite Via WhatsApp, the user is prompted to the next screen.

If the user selects the language as Telugu and inputs the name as Tejesh. This is what the referral message looks like, likewise, the message can be customized to different languages.

For Telugu:

For Hindi:

Why will users refer to the app, what are the bragworthy points:

As discussed in the above section, the bragworthy points of Jar are,

- Save your savings into gold in less than 45 seconds

- Save with the options of daily, weekly, monthly, yearly

- Invest manually in lump sums

- Save as you spend. Jar takes spare change & turns it into gold instantly

- Convert the digital gold into physical gold

- Get the gold coins and jewelry to your doorstep

- Invest and withdraw as you wish with real-time gold prices 24/7

- Invest as low as 10 Rs. daily

When to ask users to refer:

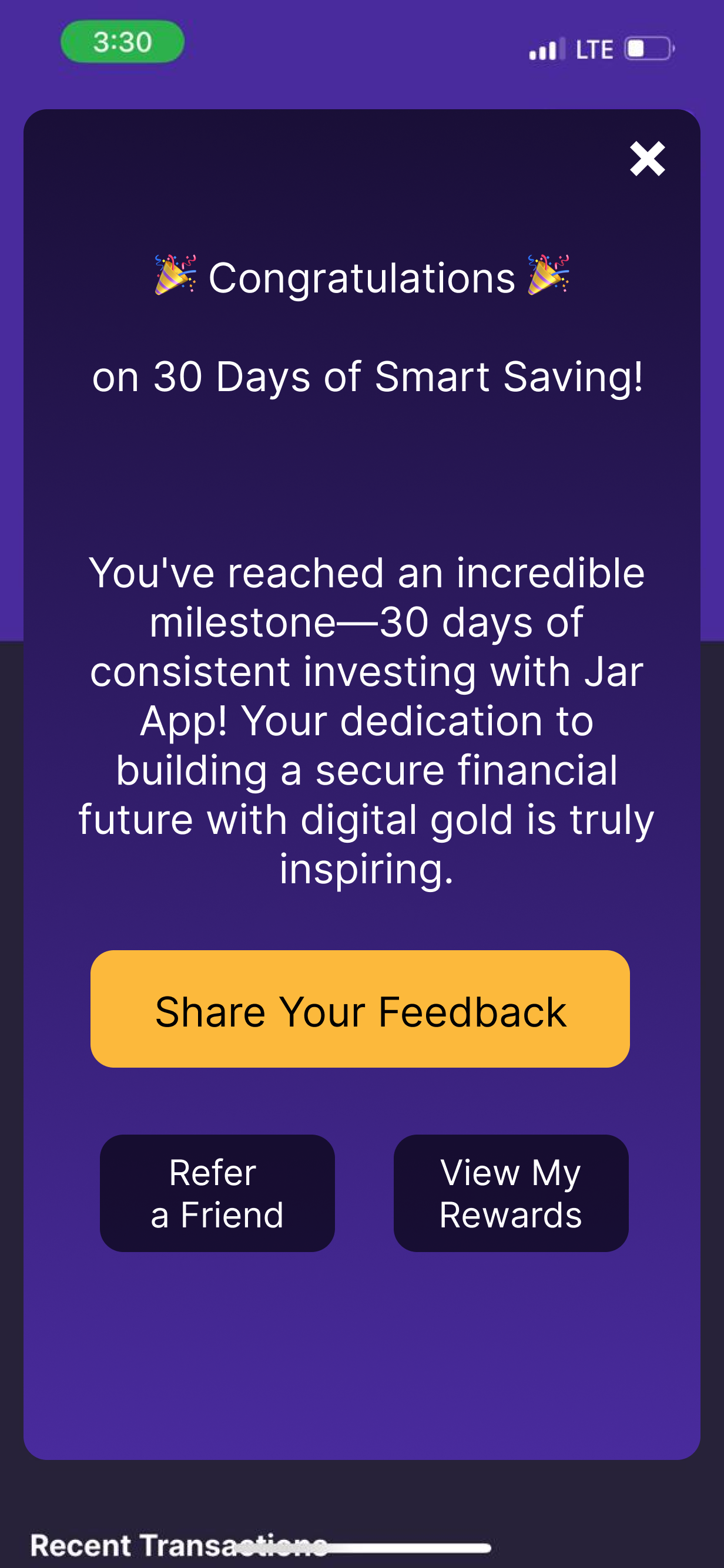

- When they have invested daily for 30 days or completed 1 month, provide a congratulatory message.

- When they have invested at least 3000 - 5000 or large ticket investment.

- When they have withdrawn their investments, convert them into gold coins and after delivery of gold.

How will they refer and discover the referral program:

For point 1 and point 2:

When they complete the first month of saving daily, we congratulate them for developing that savings habit and ask them for an app experience rating. We use these users because they have shown commitment and demonstrated their liking to the app. Post the ratings, we can ask the user for a referral.

We will provide incentives to both the referrer and the new user. E.g.: free gold worth 500 to both users.

Example message:

App screen:

App screen: WhatsApp message

For point 3:

When user converted their savings into physical gold and got their coins or jewelry to their homes. Post the successful validation we can ask users for referral. We can provide discounts and waivers in the making and delivery costs for the existing user, and discounts in the first purchase of the gold to the new user.

Example message:

How will they track the referral:

Users can track the referral via my rewards dashboard, users can check at what stage the referred users are and also have the option to check what needs to be done to complete the referral process and get their benefits.

Users can also get notified when a referred user is at the last stage of completing their referral process.

How will they keep referring to new users:

We can nudge users to continue referring more people by providing the benefits of referring more users. The benefits plan for them are as follows:

3 referrals: Rs. 500 worth of gold free through platform currency - Jar winnings

5 referrals: Flat discount on making charges of Jewelry

10 referrals: Get 0.1g worth of gold via winnings and transferred to your account

15 referrals: Get 0.5g worth of gold coins delivered to your doorstep

50 referrals: Get 1g worth of gold coins delivered to your doorstep

100 referrals: Get a trip to Malaysia, or Singapore, all charges on us

Product Integrations:

Organic intent for Jar app begins:

- Searching on Google

- Seeing YouTube videos

- Explore investment platforms related to gold

- Apps related to payments

Company | Organic Intent | Frequency | Importance | Value add to User | Ability to acquire new users |

|---|---|---|---|---|---|

Bank applications - HDFC, ICICI | Looking to save money for better returns | High | High | Yes | High |

PhonePe, Google pay | Check gold-related features or invest their savings or | High | High | Yes | High |

Uber, Ola, Rapido, Zomato, | Invest their extra savings or tips from the customers directly to the Jar | High | High | Yes | Medium |

Coin, Groww | Stability in the portfolio | Medium | High | Yes | Medium |

While making payments | Low | Medium | No | Medium |

In bank applications and payment apps the users are always thinking about money-related topics, so partnering with them would increase the chances of increasing users for Jar.

Partnership with Porter, Ola, Rapido, Zepto, Blinkit - Driver Partner Apps:

This model can be applied to any partner app, for this project I am considering the Porter app because we can target all walks of people who deliver goods on 2W, 3W, and 4W. Increasing the chances of acquiring new users.

Partnering with a driver-partner app like Porter has great potential for Jar because usually, these users are daily earners and they want to save some amount daily to invest for a large purchase in the future, particularly gold and jewelry. Adding Jar in this scenario increases the partner's financial security, stability, and well-being.

Starting the daily savings with as little as Rs. 10 helps partners with irregular income to save in digital gold without worrying about that particular day's income.

By offering this the trust factor on the partner's app increases as this sends a signal that they care about the financial well-being of their partners. This will increase retention on the app. This also brings new users to the app who are looking to save daily but can't do it for various reasons.

When partner drivers get a tip or when they want to save some amount into gold, we can provide an option for the partners to directly save them in the Jar.

This is beneficial for Jar and Partner apps as they increase employee or partner satisfaction and retention on the platform. Partner apps can also gift the users by converting their respective platform currencies into savings on the Jar platform.

Jar helps in security, any-time withdrawal of savings, real-time pricing for the purchase of gold, and also delivery of purchase to the doorstep.

Sample integration:

With WhatsApp:

With WhatsApp pay, Jar can partner with WhatsApp to set autopay for users to save their savings in the gold. We can target only users of WhatsApp pay users. Just like the example given below. The integration to the app can be added for users while they are making the payment.

With IRCTC:

By partnering with Jar, IRCTC can increase its value proposition to its large customer base. Also, the ICPs that Jar is targeting exactly match the ones IRCTC is targeting - the rural and semi-urban regions.

They can avail of the savings options while they are purchasing a ticket or they can start a daily or weekly plan which will also increase the app interaction of IRCTC increasing DAU and MAUs.

The trust in the Jar brand also increases as we are partnering with a government entity. IRCTC can also avail discounts and offers for users who have invested their savings with Jar on the platform.

For IRCTC this is an additional revenue and income stream, also a new tool to introduce financial services to their users. Jar can provide discounts to the users who have started investing via IRCTC to increase the users to its platform.

It's a win-win situation for both IRCTC and Jar with this partnership.

With Google Pay, PhonePe:

The core use case or value prop with Jar is the extra change or the round-off value is saved directly onto the Jar app, but to enable this users have to install Jar app and allow permissions.

Google Pay does not have a gold investment option for users to invest their savings. While Phonepe provides gold investment options the starting amount for daily savings is 100 Rs. This discourages new users from investing in the app. By partnering with Jar, users on the respective apps can easily set up autopay and invest in gold starting as low as Rs.10. The partnership is beneficial for both Jar and Phonepe/Google Pay as they can enjoy commission on the purchases: increased DAU, and MAU.

On the other hand, Jar can partner with the Coin app by Zerodha to invest in gold. This enhances the user's choices to make savings in gold via ETFs, Bonds, and digital gold. The same benefit can be enjoyed by the Coin.

By partnering with Phone pe and GPay, Jar can directly integrate the feature on the app, when the users are paying a merchant, paying for delivery of items, or paying for Uber, Rapido, etc.. we can ask the user through a tick button selection if they want to round off the payment and send the remaining amount into Jar for savings. Since the users on the apps have already done the KYC there is added security for the Jar.

Sample screen, for P2P payment:

Sample screen for merchant payments:

Bank partnership:

E.g.: ICICI Bank

Show a banner message on the login screen to prime users about the partnership, and once they log in, the user is prompted with a pop message with the benefits of digital gold investments. Also, an icon for users to invest in the gold.

Jar icon and messaging on the login screen of the ICICI Bank mobile app, users can directly click on the icon to take them to the Jar screen inside the bank application.

Banner message once user logins into the bank app,

Icon inside ICICI bank,

Post user clicks on the investing icon, the Jar screen pops up and the user will be able to invest directly here,

Likewise, we can partner with HDFC, and Axis banks to help their users to invest their savings in digital gold. The number of potential users Jar can acquire is very high and with this partnership, Jar can go deeper in connecting to users in tier 2 and tier 3 cities.

Final: Partnership with Porter and IRCTC:

Out of all the partnership integrations, partnering with Partner apps, IRCTC and WhatsApp are my top picks because the customers we are trying to target are the same in all these 3 apps. Each app integration has its benefits for the partners and to the Jar. So we will first start the partnership with partner apps like Porter. Then based on the feedback build on top it and get the next partner onboard.

Content Loops:

For Jar,

Hook: Helping other users learn more about gold and investing in gold. The videos and blogs can be listed in multiple languages.

Creator: YouTube videos, and blogs - Jar team

Distributor: YouTube, Substack, Email, and Medium

How will the user share: When users come across YouTube videos on gold investment, or the users who subscribed to the YouTube channel will share the videos to their friends and family through WhatsApp and Instagram.

Once users get to know about the new savings option through Jar, they will come to the Jar website or download the Jar app and start their customer journey.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.